Texas sales tax guide for SaaS businesses

Is your product taxable in Texas? Get up-to-date rates, nexus thresholds, and more from Anrok’s team of tax experts.

Automate sales tax for SaaS

2025 SaaS sales tax rates for Texas

Reach out to our team to start automating compliance for your business.

Tax rates

Nexus thresholds

Products taxed

Table of contents

Latest updates

Is SaaS taxable in Texas?

Texas taxes SaaS, as well as a large variety of digital goods and services. Texas also taxes certain professional services when sold in conjunction with sales of SaaS or digital products.

However, it is worth noting that the Texas tax code exempts 20% of the total charge for sales of certain software and digital services, which essentially means that only 80% of a taxable SaaS sale is subject to the state’s sales tax. This percentage reduction aims to encourage the growth of the technology industry within the state.

It is important to understand the tax implications of SaaS in Texas, especially if you are a business owner offering SaaS products. Texas has one of the highest combined state and local sales tax rates in the country, with an average rate of 8.19%.

This means that businesses selling goods or services within the state must be diligent in collecting and remitting the correct amount of sales tax. Failure to comply with the state’s tax laws can result in penalties and fines, so it is crucial to stay informed and up-to-date on the latest regulations.

How to determine if your product is taxable in Texas

The first step in determining whether your product is taxable in Texas is identifying whether it falls under a taxable category.

Additionally, it is essential to understand the concept of nexus. Sales tax nexus refers to the relationship between a business and a jurisdiction, which creates an obligation for the business to collect and remit sales tax on sales made within that jurisdiction. In Texas, businesses are considered to have a nexus if they meet certain criteria, such as having a physical presence or economic nexus within the state.

Physical presence can be established through various factors, such as maintaining an office, operating a warehouse, or having employees or representatives conducting business within the state. Conversely, economic nexus is established when a business exceeds a specific sales threshold within the state, even without a physical presence.

Texas’s economic nexus laws state that sellers must collect and remit sales tax if they have more than $500,000 in sales within the state during the preceding twelve months. This threshold includes the total revenue from taxable and nontaxable sales, including SaaS and digital goods, before any deductions or exemptions are applied.

Overall, understanding Texas sales tax nexus laws is crucial for businesses operating within the state. Whether through physical presence or economic activity, businesses must ensure they are in compliance with Texas sales tax laws to avoid penalties and fines.

Sales tax compliance in Texas

Ensuring sales tax compliance in Texas requires businesses to adhere to several steps, after determining taxability and nexus status in the state:

- Register for a sales tax permit: All businesses with nexus in Texas must register for a sales tax permit.

- Collect sales tax: Once you have your sales tax permit, you need to collect the appropriate amount of sales tax on taxable transactions, including any taxable SaaS products and digital goods.

- File sales tax returns: Businesses must file periodic sales tax returns, typically on a monthly, quarterly, or annual basis, depending on the sales volume. When filing the return, you need to report the total sales and taxable sales, as well as the sales tax collected during the reporting period.

- Remit collected sales tax: Along with filing your sales tax return, you must also remit the collected sales tax to the state. Failure to do so could result in penalties and interest charges.

In conclusion, sales tax regulations in Texas can be complex, particularly with regards to the taxation of SaaS and other digital products. Understanding the taxability of your specific product offerings, remaining aware of the nexus laws, and diligently complying with sales tax requirements is crucial for businesses operating in Texas. To ensure full compliance and avoid potential mistakes, it’s highly recommended that businesses seek guidance from a tax professional well-versed in Texas sales tax law, or use specialized sales tax software.

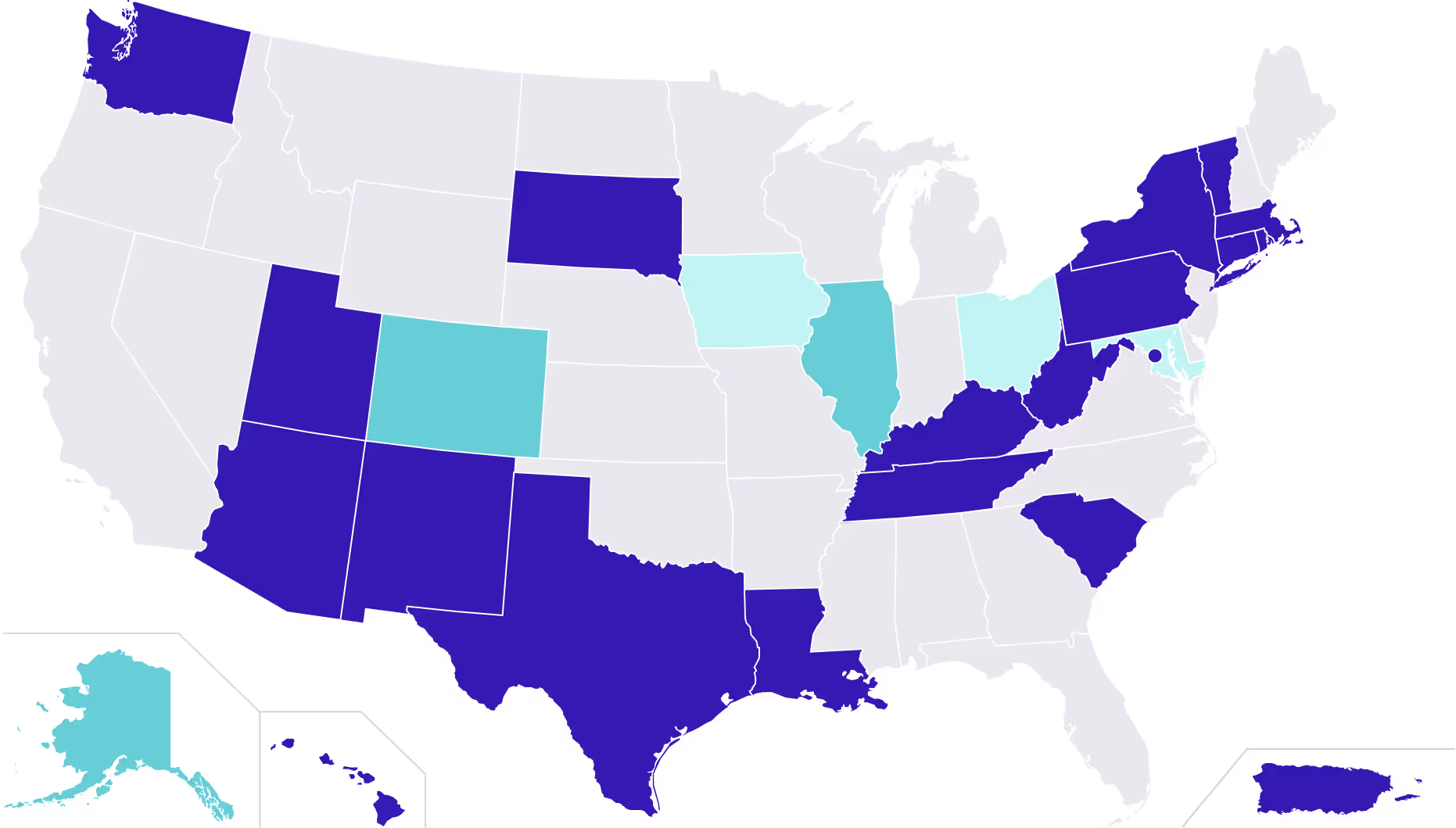

SaaS sales tax rates for every state

Up-to-date sales tax rates, nexus thresholds, and product taxability for every state, built by Anrok’s team of SaaS tax experts.

Explore the index

Automated sales tax compliance, built for SaaS

Connect your financial stack

Sync your billing, payment, and HR systems with just a few clicks

Monitor exposure across the globe

Instantly see how growing sales affect your liability—and quickly take action

Calculate sales tax in real time

Always collect the right tax, with the most accurate rules for SaaS

File and report on autopilot

Built-in filing, remittance, and reconciliation simplify reporting

%20(1).webp)