Louisiana sales tax guide for SaaS businesses

Is your product taxable in Louisiana? Get up-to-date rates, nexus thresholds, and more from Anrok’s team of tax experts.

Automate sales tax for SaaS

2025 SaaS sales tax rates for Louisiana

Reach out to our team to start automating compliance for your business.

Tax rates

Nexus thresholds

Products taxed

Table of contents

Latest updates

Is SaaS taxable in Louisiana?

As the world of technology evolves, so do tax regulations. Determining whether or not your SaaS product is taxable in the US, and especially in Louisiana, can be a complex process.

As of January 1, 2025, SaaS is generally taxable at the state level in Louisiana, along with some digital goods and services.

It’s crucial to note that Louisiana has a unique tax system that includes state, parish, and municipal sales taxes. The rates and rules for each of these taxes can vary, making it essential to stay up-to-date on any changes in the tax laws.

Like cities in Colorado, Illinois, or Alaska, home rule jurisdictions in Louisiana are allowed to determine their own taxability and rates. This means that taxability must be determined for each city or parish in Louisiana, not just at the state level.

If you’re unsure about the taxability of your product, it’s best to consult with a tax professional who can help you navigate the state’s tax laws.

How to determine if your product is taxable in Louisiana

To determine your sales tax obligations in Louisiana, you need to analyze the products you offer and whether they fit the criteria for taxation.

Another factor to consider is whether you have sales tax nexus in Louisiana. Nexus is a connection between a seller and a state that requires the seller to collect and remit sales tax.

In Louisiana, nexus is established if a seller has any of the following:

- A physical presence in the state, such as a retail store, office, or warehouse

- Employees, agents, or independent contractors conducting business on behalf of the seller in the state

- Inventory stored in the state, including items stored in a third-party fulfillment center

- Meeting a sales threshold of $100,000 in gross sales or 200 or more separate transactions within a 12-month period

If your business meets any of these criteria, you are likely required to collect and remit sales tax on your taxable product in Louisiana.

Sales tax compliance in Louisiana

Once you have determined that your SaaS or digital product is taxable in Louisiana and that your business has nexus in the state, it’s essential to ensure that you are correctly collecting and remitting sales tax. Sales tax compliance involves several steps, including:

- Register for a sales tax permit: All businesses with nexus in Louisiana must register for a sales tax permit.

- Collect sales tax: Once you have your sales tax permit, you need to collect the appropriate amount of sales tax on taxable transactions, including any taxable SaaS products and digital goods.

- File sales tax returns: Businesses must file periodic sales tax returns, typically on a monthly, quarterly, or annual basis, depending on the sales volume. When filing the return, you need to report the total sales and taxable sales, as well as the sales tax collected during the reporting period.

- Remit collected sales tax: Along with filing your sales tax return, you must also remit the collected sales tax to the state. Failure to do so could result in penalties and interest charges.

Staying up-to-date with sales tax laws and maintaining compliance can be complicated and time-consuming. Nevertheless, understanding the taxability of your SaaS and digital products in Louisiana and ensuring you follow the state’s nexus laws and compliance requirements is crucial to avoid potential fines and penalties.

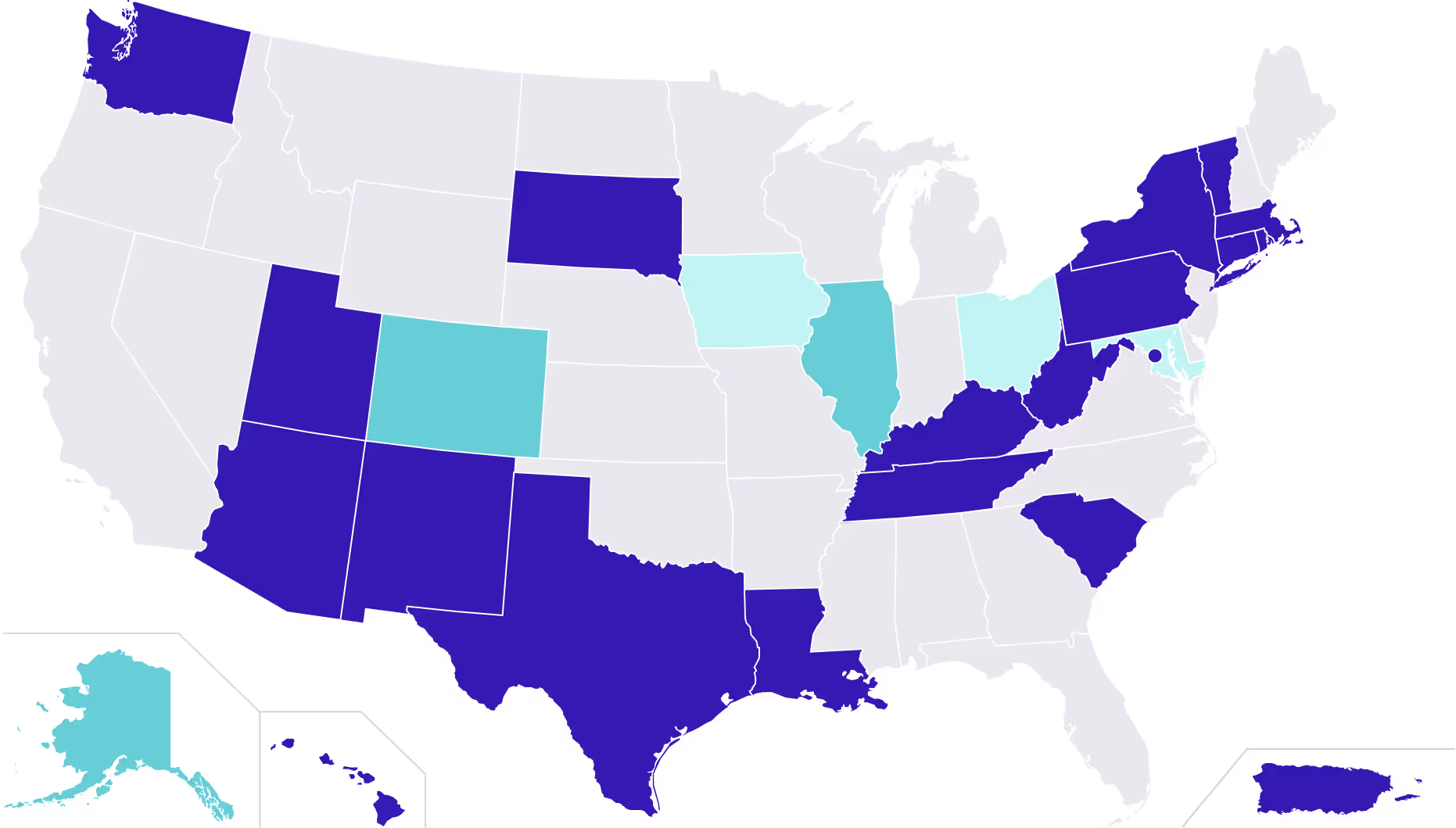

SaaS sales tax rates for every state

Up-to-date sales tax rates, nexus thresholds, and product taxability for every state, built by Anrok’s team of SaaS tax experts.

Explore the index

Automated sales tax compliance, built for SaaS

Connect your financial stack

Sync your billing, payment, and HR systems with just a few clicks

Monitor exposure across the globe

Instantly see how growing sales affect your liability—and quickly take action

Calculate sales tax in real time

Always collect the right tax, with the most accurate rules for SaaS

File and report on autopilot

Built-in filing, remittance, and reconciliation simplify reporting

%20(1).webp)