Missouri sales tax guide for SaaS businesses

Is your product taxable in Missouri? Get up-to-date rates, nexus thresholds, and more from Anrok’s team of tax experts.

Automate sales tax for SaaS

2025 SaaS sales tax rates for Missouri

Reach out to our team to start automating compliance for your business.

Tax rates

Nexus thresholds

Products taxed

Table of contents

Latest updates

Is SaaS taxable in Missouri?

Missouri does not currently tax any digital goods or services, including SaaS. Laws and regulations on this matter may change, so it is always a good idea to stay updated on the latest developments from the Missouri Department of Revenue.

How to determine if your product is taxable in Missouri

While digital products aren’t currently taxable in Missouri, it’s important to understand how to determine your sales tax obligations if that changes. And because sales tax laws vary widely across US states and cities, your digital products could be subject to sales tax anywhere you have nexus.

The concept of nexus plays a crucial role in sales tax compliance. Nexus, in the context of sales tax, refers to the connection between a seller and a state that requires the seller to collect and remit sales tax. In Missouri, like in other states, a nexus can be established through various means, including:

- Physical presence: Having a place of business, inventory, or employees in Missouri can create a sufficient nexus for sales tax purposes.

- Economic nexus: If a business has no physical presence but meets a predefined threshold of sales revenue or transaction volume within the state, it can still establish an economic nexus. In Missouri, the threshold is currently $100,000 in annual sales.

It is essential for businesses to understand the nexus laws and guidelines in Missouri to ensure proper sales tax compliance and reduce the risk of costly penalties and audits.

Sales tax compliance in Missouri

For businesses with nexus in Missouri, maintaining sales tax compliance is vital for reducing the risk of penalties, audits, and damage to your reputation. The process can be challenging, but the following steps can help ensure successful sales tax compliance:

- Register for a sales tax permit: All businesses with nexus in Missouri must register for a sales tax permit.

- Collect sales tax: Once you have your sales tax permit, you need to collect the appropriate amount of sales tax on taxable transactions, including any taxable SaaS products and digital goods.

- File sales tax returns: Businesses must file periodic sales tax returns, typically on a monthly, quarterly, or annual basis, depending on the sales volume. When filing the return, you need to report the total sales and taxable sales, as well as the sales tax collected during the reporting period.

- Remit collected sales tax: Along with filing your sales tax return, you must also remit the collected sales tax to the state. Failure to do so could result in penalties and interest charges.

By following these steps and staying informed about Missouri’s sales tax regulations, businesses can maintain sales tax compliance and focus on their core operations with peace of mind.

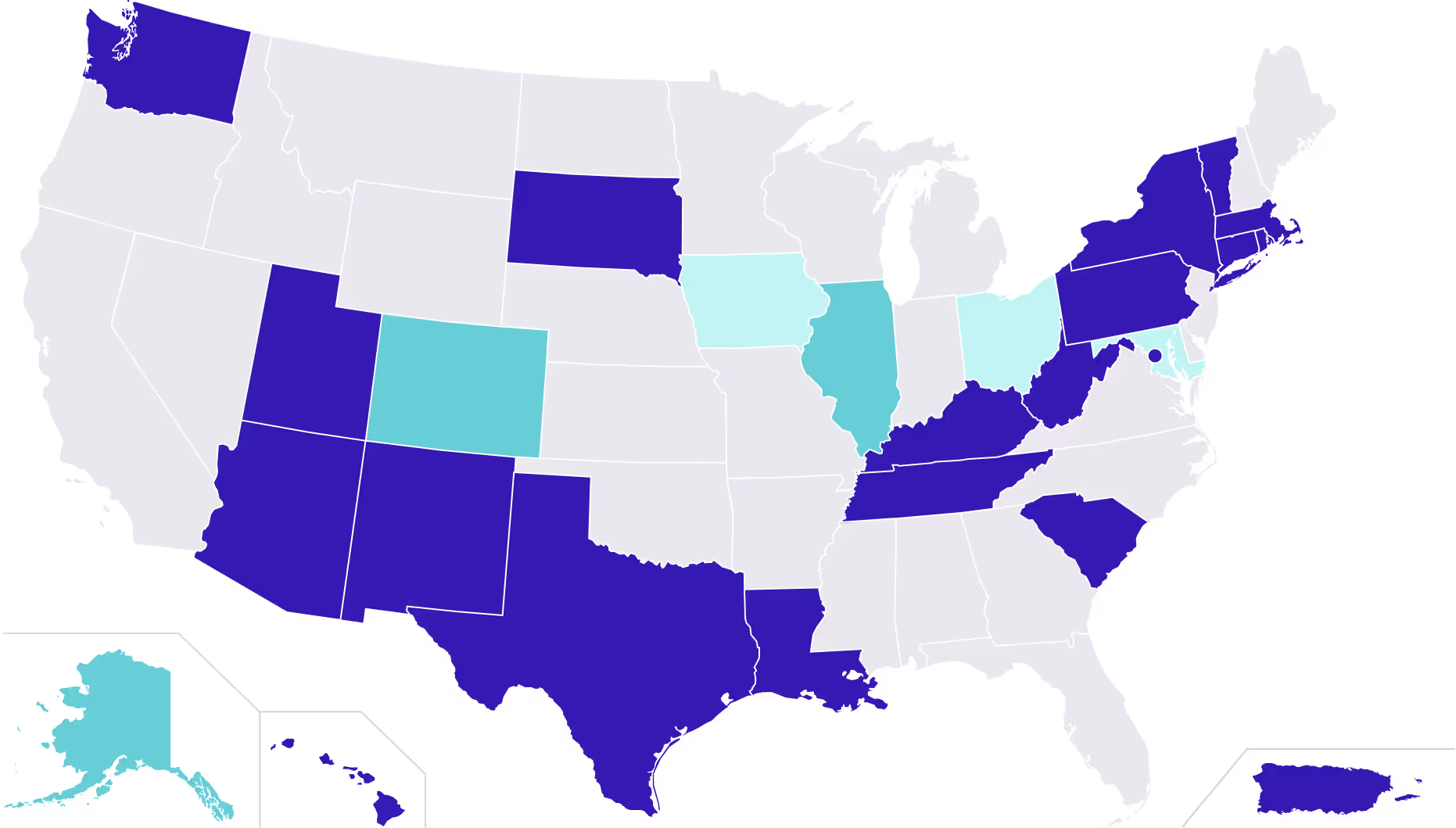

SaaS sales tax rates for every state

Up-to-date sales tax rates, nexus thresholds, and product taxability for every state, built by Anrok’s team of SaaS tax experts.

Explore the index

Automated sales tax compliance, built for SaaS

Connect your financial stack

Sync your billing, payment, and HR systems with just a few clicks

Monitor exposure across the globe

Instantly see how growing sales affect your liability—and quickly take action

Calculate sales tax in real time

Always collect the right tax, with the most accurate rules for SaaS

File and report on autopilot

Built-in filing, remittance, and reconciliation simplify reporting

%20(1).webp)