Alabama sales tax guide for SaaS businesses

Is your product taxable in Alabama? Get up-to-date rates, nexus thresholds, and more from Anrok’s team of tax experts.

Automate sales tax for SaaS

2025 SaaS sales tax rates for Alabama

Reach out to our team to start automating compliance for your business.

Tax rates

Nexus thresholds

Products taxed

Table of contents

Latest updates

Is SaaS taxable in Alabama?

Alabama generally taxes digital products such as software, movies, music, and e-books, but does not currently tax SaaS.

It’s important to note that the way SaaS and other digital products is classified can vary between US states. Explore Anrok’s sales tax index to get the latest information on SaaS taxability.

How to determine if your product is taxable in Alabama

To determine whether your business is responsible for collecting and remitting sales tax in Alabama or another US state, you must identify whether your product falls into a taxable category.

Additionally, you must understand the concept of nexus. Sales tax nexus determines if a company has a significant presence within the state to justify the imposition of tax requirements by the state. Companies that establish nexus are obligated to register and collect sales tax on taxable transactions within the state.

Physical presence is one of the most common ways to establish nexus in any state. A business with a physical presence within the state, such as an office or employees, is required to collect sales tax. This may also include businesses that have a warehouse, distribution center, or any other physical location within the state. Even if the business is located outside of Alabama, if it has a sufficient physical presence within the state, it must collect and remit sales tax on taxable transactions within the state.

Another way to establish nexus in Alabama is through economic nexus. A business that meets a set threshold of $250,000 in annual sales is obligated to collect sales tax even if it lacks a physical presence in the state. This means that even if a business does not have a physical location in Alabama, if it meets the economic nexus threshold, it must collect and remit sales tax on taxable transactions within the state.

It is important for businesses to understand the sales tax nexus laws in Alabama to ensure compliance with state regulations. Failure to collect and remit sales tax when required can result in penalties and interest charges. Businesses should consult with a tax professional to determine if they have nexus in Alabama and to ensure they are meeting all state requirements for sales tax collection and remittance.

Sales tax compliance in Alabama

If you have determined that your SaaS product is taxable in Alabama and you have sufficient nexus, the first step towards compliance is to register for a sales tax permit with the Alabama Department of Revenue. Once registered, you will be assigned a sales tax account number, which should be displayed on all invoices and receipts for taxable transactions.

After obtaining a sales tax permit, it's crucial to accurately collect sales tax from your customers based on their location within Alabama. Alabama’s state sales tax rate is 4%, and local jurisdictions may impose additional sales taxes. This may require implementing sales tax calculation software or regularly updating your tax rate tables to reflect the most current rates.

Once collected, sales tax must be remitted to the Alabama Department of Revenue according to the filing frequency assigned to your business, which may be monthly, quarterly, or annually. You'll need to report your total sales revenue, taxable sales, total sales tax collected, and any applicable deductions or exemptions. Be sure to file your return and remit any sales tax due by the assigned due date to avoid penalties and interest.

For SaaS providers operating in multiple states, tax compliance can be a complex process. It's essential to understand the taxability of your SaaS product in each state, collect the appropriate sales tax rates, and comply with each state's filing requirements. Utilizing tax professionals or software solutions can be invaluable in managing multi-state SaaS tax obligations and ensuring sales tax compliance.

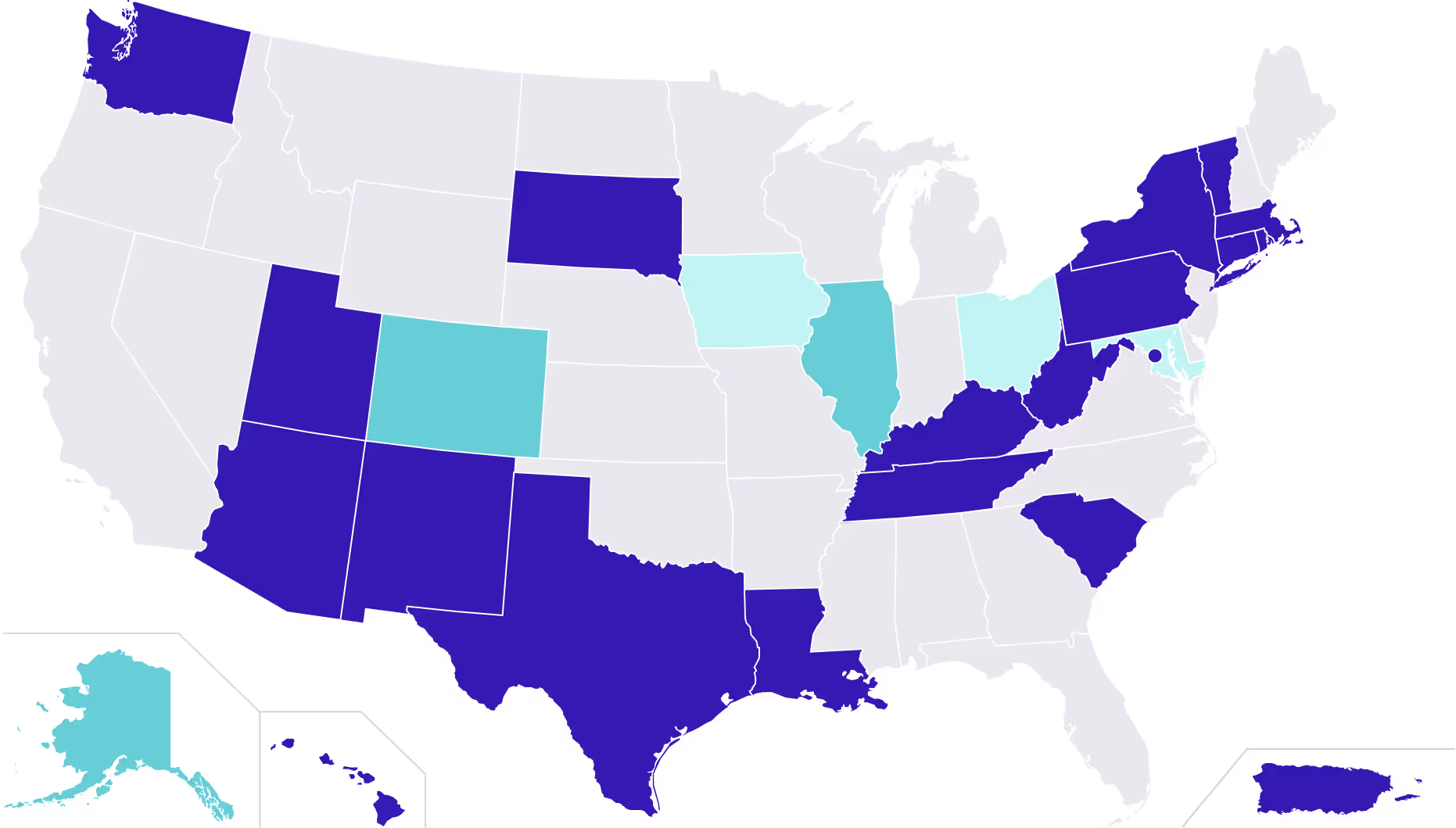

SaaS sales tax rates for every state

Up-to-date sales tax rates, nexus thresholds, and product taxability for every state, built by Anrok’s team of SaaS tax experts.

Explore the index

Automated sales tax compliance, built for SaaS

Connect your financial stack

Sync your billing, payment, and HR systems with just a few clicks

Monitor exposure across the globe

Instantly see how growing sales affect your liability—and quickly take action

Calculate sales tax in real time

Always collect the right tax, with the most accurate rules for SaaS

File and report on autopilot

Built-in filing, remittance, and reconciliation simplify reporting

%20(1).webp)