CFOs everywhere have the same challenge: figuring out how to handle large amounts of data from across the company and make sure it all matches up. This is a major task even if every team in the business uses integrated software, but in many cases much of the necessary data is contained in disparate systems that don’t talk to each other.

As a result, CFOs these days are on an ongoing hunt for tech tools that can enhance finance workflows by automating processes and enabling collaboration. Doing so helps finance teams better meet the demands of the strategic role they are increasingly taking up in today’s companies.

The financial stack is evolving

Finance is seen as a strategic function in today’s businesses; CFOs and their teams are expected to support sales to close deals and to advise C-suite leaders on financial repercussions of important decisions. Tapping into evolving tech resources is essential for CFOs as finance takes a more central place in company operations.

The spreadsheets that have typically been put to use for finance workflows like annual planning, quarterly reporting, and reconciliation lack automation and collaboration features. While spreadsheets certainly have their place, modern-day CFOs know that other tools, especially more integrated and collaborative systems, are sometimes necessary to ensure accuracy and provide essential analysis.

As new tools come online, CFOs have the chance to transform workflows from manual and disconnected to automated and collaborative. And as a result, the CFO tech stack is in a state of constant evolution, getting better and more helpful all the time. CFOs are able to tap into resources that suit their unique business model in order to grow revenue fast.

For subscription-based businesses in particular, tech is an essential element of finance teams’ success, as the processes they must handle are more complex than retail or traditional software licensing. As these businesses increase in number, so do the tools that serve their particular needs.

Automation is key in finance software

Finance teams are busy, as they must keep up with many competing priorities, all of which require handling data. Automation can vastly speed up processes, especially those repeated demands that can take up large amounts of employees’ time.

Considering the high expense of headcount in today’s market, helping employees do more in less time is imperative. By automating rote tasks, software tools help finance team members devote more time to higher-value work that helps push the company forward. Tools can also reduce the ramp time required when onboarding new employees that may not have worked with usage-based billing, sales tax, headcount planning, or the many other tasks at hand.

Another advantage of automation is accuracy; less manual intervention leads to cleaner data. Accuracy is paramount for finance teams, especially when their work contributes to executive decision-making that can have major repercussions. Automated tools reduce errors without requiring extra time and energy from the finance team.

The modern finance stack, by company stage

The finance tech stack by necessity must evolve as the company grows. Processes that can be handled by accounting software and a few spreadsheets at one stage may become unwieldy in the next level of growth.

Here’s a run-down of how the CFO tech stack may evolve as the company grows and some of the best tools for the job at each given stage.

Startup

At this stage, companies often outsource finance or have an ops person in charge, are sensitive to price, and look for ways to manage repeatable processes. Some of the tools we commonly see at this stage are:

Growth

At this stage, an in-house finance function may be in place, and that person or team may prioritize ease of implementation, scalability, and the ability to centralize data analysis. Some of the tools commonly in use at this stage are:

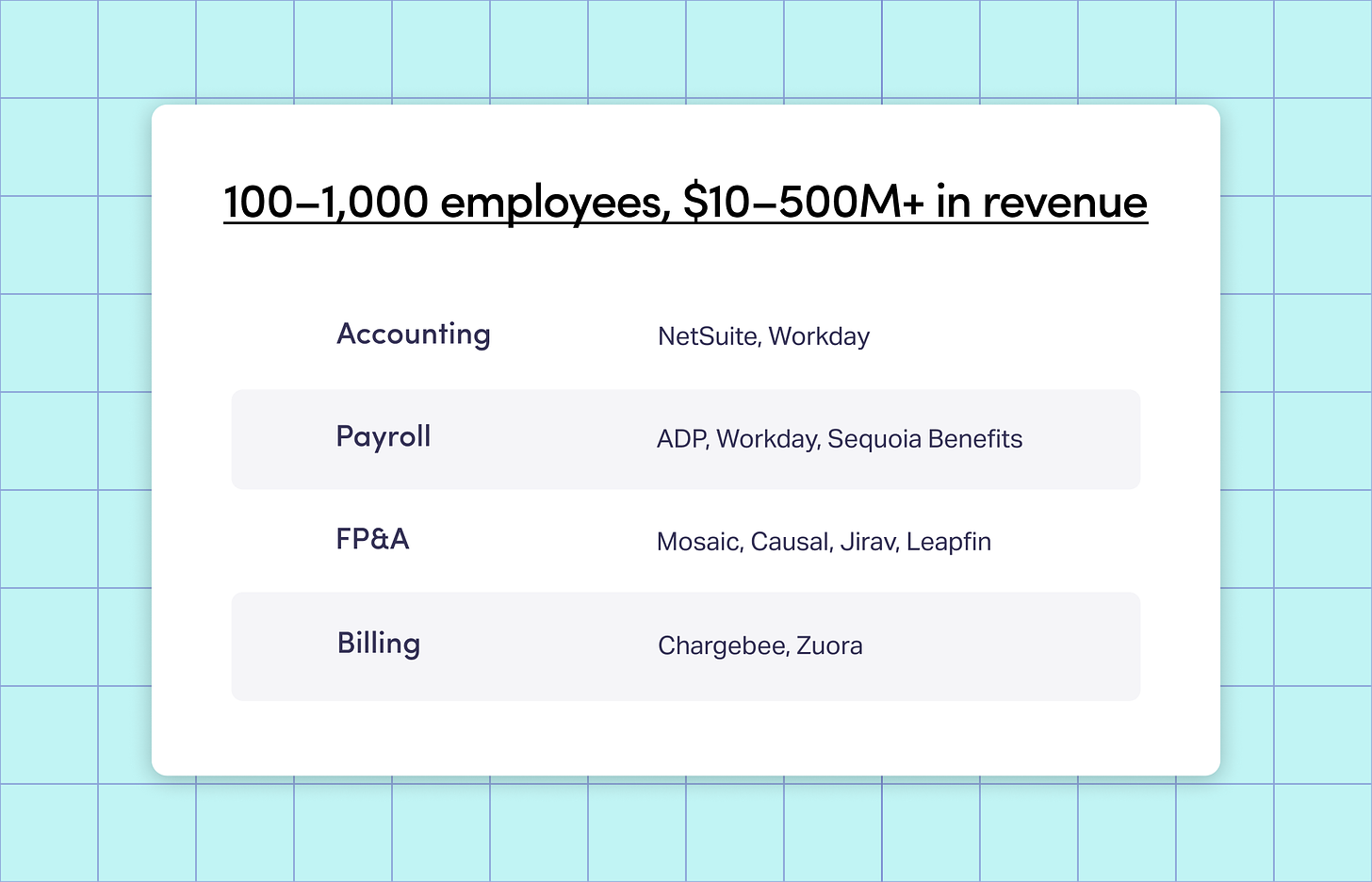

Scaled

At this stage, finance teams most value collaboration capabilities, auditability, and automation. The most highly valued tools in these environments boast end-to-end functionality. Some of the tools commonly is use at this stage are:

Evolution is ongoing

The above listing of useful tools is a point-in-time snapshot; this will surely change as finance continues to take on a more strategic role and as software vendors continue to improve their offerings. The opportunity for CFOs to enhance their tech stacks and get their tools increasingly dialed into their teams’ needs will only grow as the software environment evolves.

Companies that are ready to invest in finance software that boosts performance, improves efficiency, and enhances data-driven decision-making ability will find that their finance teams are more functional and valuable than ever before. All the more so if they are ready to iterate repeatedly over time as the CFO works to evolve the team’s tech stack to be the ideal FinanceOS for the business. ⊞