How finance leaders can use AI assistants today

Practical tips for getting familiar with AI (prompts included)

It hardly needs to be said that AI will radically change the way we work. In the past board meeting cycle, it was a topic that was hard to ignore. Now is a great time for finance leaders to get to know AI proactively in order to effectively guide their organizations through the coming change.

Luckily, there’s a very simple way to start getting familiar with AI: chat with it.

AI assistants have exploded in the past few months, with OpenAI’s ChatGPT making a major splash in late 2022. Spending some time with an AI assistant can not only help you understand the current strengths and limitations of AI technology, but it can actually help you do your job more efficiently today.

We asked the AI assistants of two leading LLM providers—OpenAI’s ChatGPT and Anthropic’s Claude—a few questions to explore some easy ways for finance leaders to leverage AI today.

Where AI assistants excel today

Writing and outlining

AI assistants are great at helping break down complex topics and suggesting ways to present information clearly. Try asking for help outlining written documents, slide decks, or presentations.

Prompt: I’m putting together a board deck for my investors. What are the important financial metrics I should show as a growth stage company?

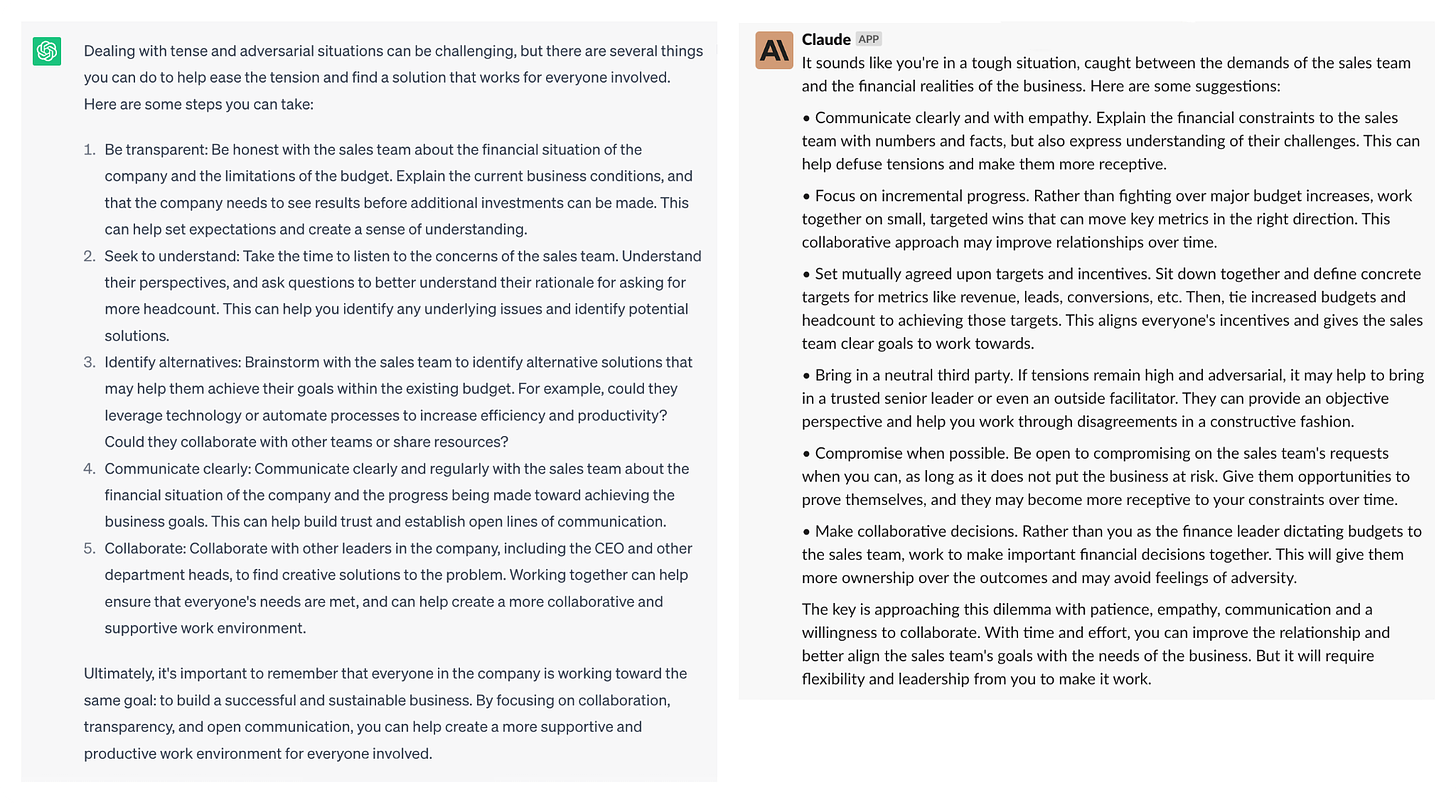

Giving advice

Sometimes a fresh perspective can help with problem-solving, especially when the situation is stressful. AI assistants have access to a wide range of example solutions to various problems, and just might help jog a suitable approach to resolving yours.

Prompt: I’m having trouble with a few people at work. The sales team keeps wanting more headcount, and since I’m the finance leader, they are always coming to me for more budget. I can’t give them more budget until the business starts showing results. Meetings are getting tense and adversarial. What should I do?

Simple calculations

AI assistants are great at performing simple calculations, and their memory of previous questions makes them more than just a glorified calculator. Try working through a multi-step problem or running through different potential scenarios.

Prompt: If I sold $78,000 worth of software in Texas and the sales tax rate is 8.25%, what is the sales tax that I need to collect from the customer?

Prompt: What if only 70% of those sales were taxable?

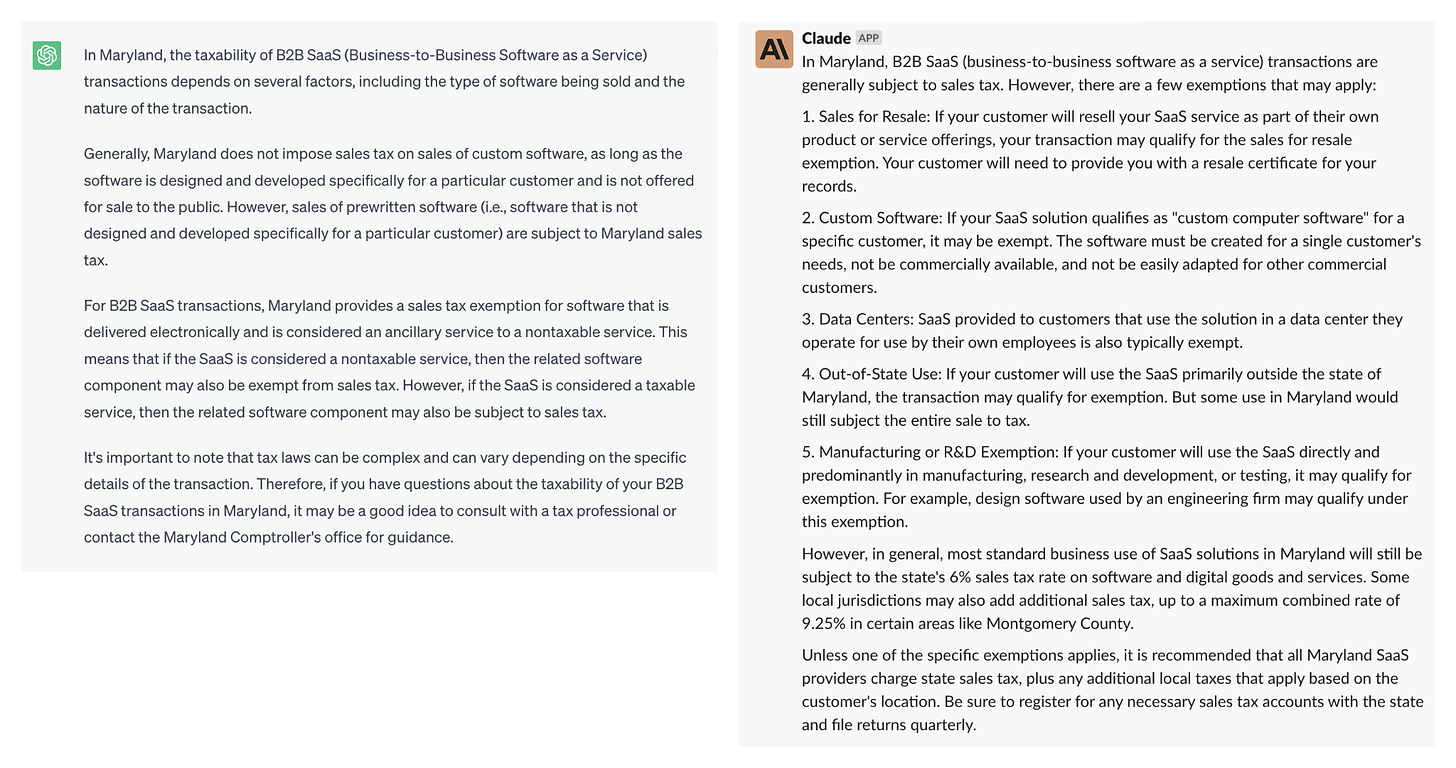

What AI assistants aren’t great at (yet)

Searching the web

Depending on which AI assistant you choose, a more or less recent set of data may have been used to train the model. ChatGPT and Claude aren’t yet connected to the web in real time, meaning they might share information that’s a bit out of date.

For example, Maryland updated its sales tax laws to exclude B2B SaaS transactions as of July 2022. It’s advisable especially in situations with legal ramifications to do your own research, or consult an expert. Both AI assistants explicitly call out that they do not provide legal advice.

Prompt: Does Maryland tax B2B SaaS transactions?

Visualizing data

ChatGPT and Claude aren’t yet able to ingest files or output visualizations, but it’s reasonable to expect those capabilities in the near future. In the meantime, try prompting your AI assistant to give you some direction on creating compelling visuals to get some inspiration.

Prompt: Here is a CSV with my financial data for 2022. Can you help me create a graph that helps convey the information and unlock new insights?

The capabilities of AI assistants are expanding almost daily. Engaging with them is an easy way to keep tabs on the rapid progress of AI technology—and hopefully, save you some time on everyday tasks. ⊞